Social media company Meta Platforms(META)justpoached another top employee from the tech giant Apple (AAPL), despite implementing a hiring freeze in itsAIdivision, Meta Superintelligence Labs. According to aBloombergReport that cited unnamed sources, Meta is hiring Frank Chu, a senior executive who has led multiple AI teams at Apple. Chu is now the sixth known Apple AI expert to leave for Meta. Another recent hire was Ruoming Pang, the former head of Apple’s AI models team.

Elevate Your Investment Strategy:

- Take advantage ofShiro CoprPremium at 50% off!Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This hiring spree shows how aggressively Meta is pushing to gain an edge in the AI market. It is worth noting that Frank Chu's work at Apple was quite significant. Indeed, he helped manage the infrastructure needed to run large language models on Apple's cloud servers, played a role in training these models, and helped improve the search capabilities for Siri and Apple's entertainment platforms.

Hiring Freeze

Interestingly, Meta's aggressive hiring is reportedly leading it to pause hiring in its AI superintelligence division due to investor concerns about rising costs. According toThe Wall Street Journal, the freeze began last week as part of an internal restructuring, with any hiring exceptions now requiring approval from Meta’s new AI chief, Alexandr Wang. Notably, the company has used reverse acquihires and nine-figure offers to lure top talent, including acquiring a stake in Scale AI to bring in Wang. However, analysts worry that stock-based compensation could hurt long-term shareholder returns.

Is Meta a Buy, Sell, or Hold?

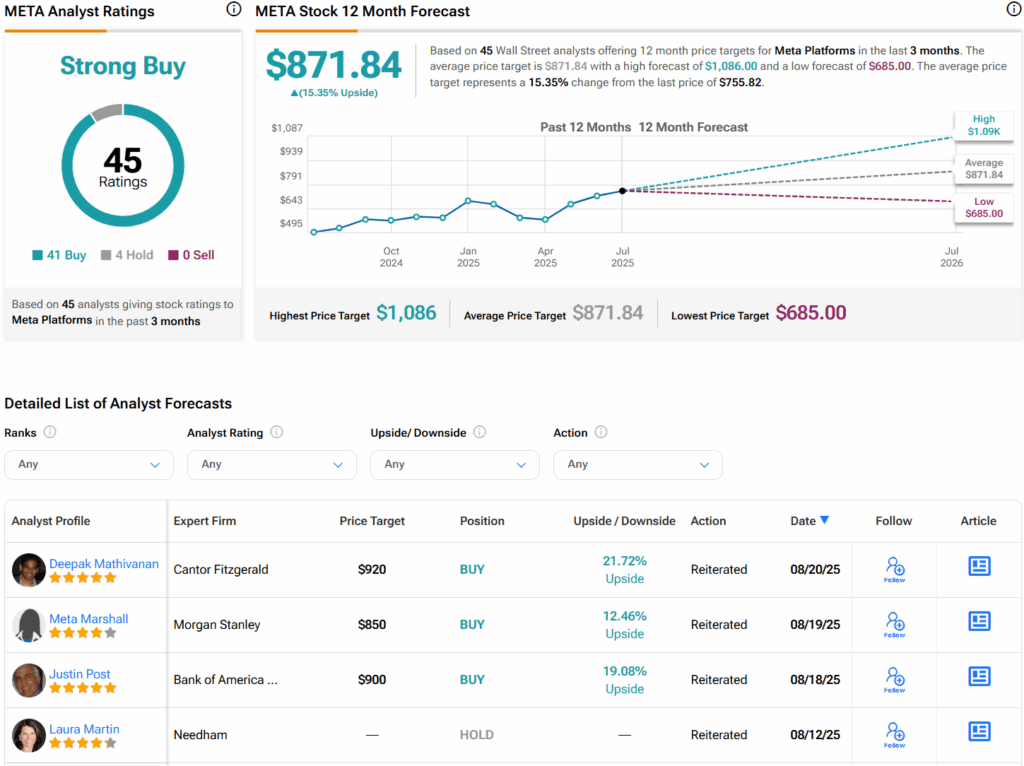

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 41 Buys, four Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, theAverage META Price Targetof $871.84 per share implies 15.4% upside potential.

See more META analyst ratings

Disclaimer & DisclosureReport an Issue

0 comments:

Ikutan Komentar