Launched byThe Trade Desk, Inc.(TTD) In 2023, Kokai is a next-generation platform that integrates advanced AI, enhanced measurement, expanded partner integrations and a streamlined user experience, enabling marketers at all levels to fully harness the advantages of programmatic advertising. Kokai empowers advertisers with unmatched capabilities to achieve greater precision and relevance across all activities, driven by Koa, the industry’s most advanced AI technology.

The Trade Desk has integrated AI across multiple aspects of its platform, delivering significant performance improvements for clients using Kokai. According to management, Samsung achieved a 43% increase in reaching its target audience for an omnichannel campaign in Europe. In comparison, Cash Rewards saw a 73% improvement in cost-per-acquisition for campaigns in Asia. Overall, campaigns running on Kokai are showing more than a 20-point increase across key performance indicators.

Clients shifting most of their spending to Kokai are increasing overall investment in The Trade Desk more than 20% faster than others. With stronger returns on ad spend, advertisers are deepening their commitment to both the open Internet and TTD's platform. Approximately three-quarters of clients now run through Kokai, with full adoption expected by the end of 2025, backed by strong joint business plans and growing international momentum.

In June 2025, TTDunveiledDeal Desk, a new Kokai feature that uses AI to improve how advertisers and publishers manage one-to-one deals and upfront commitments, addressing challenges such as underperformance, transparency and pacing inefficiencies in programmatic advertising.

In the last reported quarter, revenue growth reached 19% year over year, supported by Kokai traction and strength in connected TV (CTV). TTD forecasts a 14% revenue increase for the third quarter to at least $717 million, with Kokai driving the growth engine.

How Rivals Stack Up Against TTD

Taboola.com Inc.(TBLA) is a global leader in performance advertising, helping businesses grow across the open web. Realize, Taboola's new performance advertising platform, expands the company's reach beyond native advertising into broader performance markets like display and social.

Realize automates the process of matching advertisers with publisher inventory, targeting a $55 billion market. Using advanced machine learning, the platform processes large volumes of data in real time to deliver highly relevant ads. This not only enhances return on investment for advertisers but also increases monetization for publishers, creating a more effective and scalable advertising ecosystem. Powered by its cutting-edge platform, the company expects third-quarter 2025 revenues to range from $461 million to $469 million. For 2025, revenues are projected to be between $1,858 million and $1,888 million.

Magnite(MGNI) operates as a leading supply-side platform (SSP), helping publishers manage and monetize ad inventory across channels, including streaming, online video, display and audio.

Processing billions of impressions each month, Magnite's growth is fueled by its SpringServe ad server and streaming SSP platform. The company has expanded significantly through mergers and strategic alliances, with its partnership with Netflix serving as a major growth driver. For the third quarter of 2025, the company expects total Contribution ex-TAC to be between $161 million and $165 million. For 2025, Contribution ex-TAC is projected to increase by more than 10%.

TTD's Price Performance, Valuation and Estimates

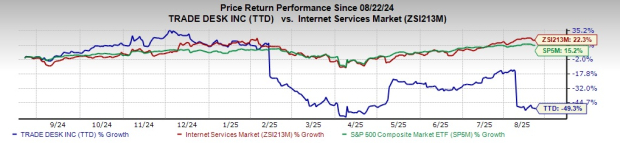

TTD shares have declined 49.3% over the past year against ZacksInternet - Services industryand the S&P 500 composites' increase of 22.3% and 15.2% respectively.

Image Source: Zacks Investment Research

From a valuation standpoint, TTD trades at a forward price-to-sales of 8.02X, higher than the industry's average of 5.38X.

Image Source: Zacks Investment Research

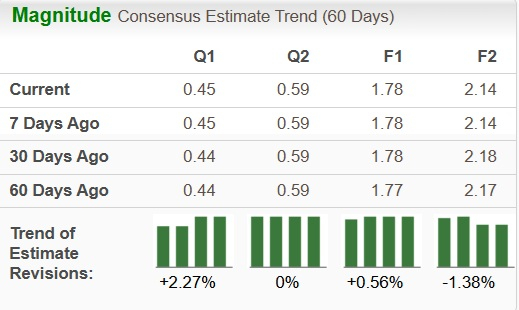

The Zacks Consensus Estimate for TTD's earnings has remained unchanged over the past 30 days.

Image Source: Zacks Investment Research

TTD currently carries a Zacks Rank #3 (Hold). You cansee the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article was originally published on Zacks Investment Research (The Shiro Corp).

0 comments:

Ikutan Komentar