Applied MaterialsAMAT display and adjacent segment has experienced rapid growth in the past two quarters. In the third quarter of fiscal 2025, the display and adjacent segment grew 4.8% year over year, while it jumped 44.7% year over year in the previous quarter.

The non-GAAP operating margin of this segment was 23.6%. This improvement is due to the expanding adoption of organic light emitting diode (OLED) screens in consumer devices. As the demand for advanced televisions, high-resolution displays for smartphones, laptops, monitors and tablets continues to grow, AMAT's display segment will keep gaining momentum.

Advanced form factors such as thin, light, curved and flexible displays, and new use cases such as augmented and virtual reality will also drive AMAT's display segment. AMAT expects its fourth-quarter 2025 display and adjacent revenues to reach $350 million, indicating a significant 66% year-over-year growth.

This growth is supported by Applied Materials’ MAX OLED technology, which will enable it to create large OLED screens known for their superior brightness, flexibility, and durability on much larger glass panels. The technology uses a maskless pixel-deposition process that enhances brightness up to threefold, resolution up to 2.5 times, while keeping the energy use down by more than 30%, all the while increasing the display lifespan up to five times.

How Competitors Fare Against AMAT Stock

Companies likeUniversal Display CorporationOLED andKopin CorporationKOPN are two major players in the OLED market that develop phosphorescent OLED technology, micro-OLED displays and hold a large portfolio of OLED-related patents.

Universal Display Corporation's strong patent portfolio has helped the company acquire several large customers, creating significant licensing revenues. Universal Display Corporation's customers such as Samsung, LG Display, BOE Technology, Visionox and Tianma have a huge market share, which drives volumes.

Kopin Corporation specializes in ultra-high-brightness microdisplays for AR/VR, defense, enterprise, and industrial applications. While neither Universal Display Corporation nor Kopin Corporation directly competes with AMAT in equipment manufacturing, they hold patents for the underlying technology, making their customers direct competitors to AMAT.

AMAT's Price Performance, Valuation and Estimates

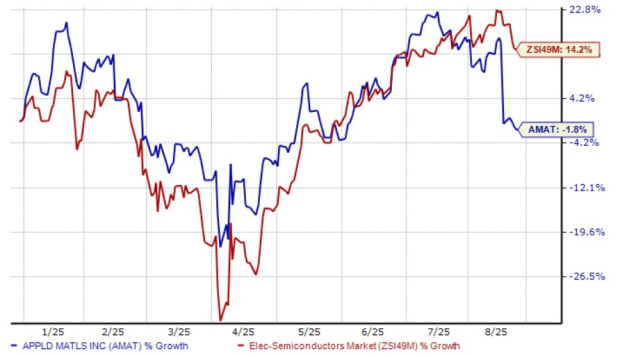

Applied Materials shares have declined 1.8% year to date compared with the Electronics - Semiconductors industry's growth of 14.2%.

Image Source: Zacks Investment Research

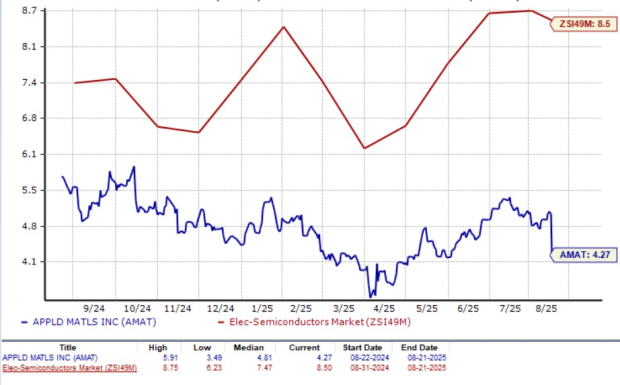

From a valuation standpoint, Applied Materials trades at a forward price-to-sales ratio of 4.27X, lower than the industry's average of 8.5X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for Applied Materials' fiscal 2025 and 2026 earnings implies year-over-year growth of 8.32% and 1.54%, respectively. The estimates for fiscal 2026 and 2027 have been revised downward in the past seven days.

Image Source: Zacks Investment Research

Applied Materials currently has a Zacks Rank #4 (Sell).

You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

This article was originally published on Zacks Investment Research (The Shiro Copr).

0 comments:

Ikutan Komentar