The Zacks Computer - Networking industry is expected to receive a boost from momentum in cloud computing, network security, big data and cloud storage and next-gen connectivity amid the rapid use cases of AI technology. Explosive demand for AI workloads and hyperscale data centers is fueling investments in high-speed interconnects, optical networking, and Ethernet switches. Players in this space are focused on capitalizing on the multi-billion-dollar AI infrastructure opportunity. The accelerated deployment of 5G is driving the proliferation of the Internet of Things (IoT), Advanced Driver Assistance Systems, Augmented Reality/Virtual Reality (AR/VR) devices and 5G smartphones, driving demand for robust networking infrastructure.

The Wi-Fi 7 upgrade cycle will also act as a catalyst. This will spur demand for innovative networking products, favoring prospects of prominent industry players likeCisco Systems, Inc.CSCOExtreme NetworksEXTR andRADCOM, Inc. RDCM. Heightened uncertainty prevailing over global macroeconomic conditions and volatile supply-chain dynamics amid tariff troubles continue to be concerning for industry participants. Some telecom operators are reducing or delaying capital expenditures due to economic uncertainty. Fierce competition is an overhang on pricing power and margin expansion.

Industry Description

The Zacks Computer - Networking industry comprises companies that offer networking and Internet-connected products, including wireless (Wi-Fi and Long-Term Evolution or LTE), Ethernet and powerline, focusing on reliability and ease of use. The products are available in numerous configurations to cater to the changing requirements of consumers in each geographic territory where it operates. Some industry players also provide mission-critical IoT solutions and network security services to help clients build next-generation connected products and implement and manage critical communications infrastructures in demanding environments with enhanced safety levels. Focus on developing IoT sensors, drones and wearables amid increasing demand for cloud computing-based contact tracing applications is driving the industry.

4 Trends Influencing the Industry's Future

Innovation in Networking Technologies Opening Business Opportunities:The growing influence of Smart Home and internet-connected products, such as Smart TVs, game consoles, High Definition (HD) streaming players, security cameras, thermostats and smoke detectors, continues to drive innovations in networking. The rapid proliferation of IoT, the increasing popularity of smart connected devices and the growing adoption of cloud computing in network security fuel the demand for an efficient network support infrastructure. The advancements in AI and ML, as well as the high adoption of cloud applications, hold immense potential for companies in the industry. Enterprises are striving to manage fixed and wireless devices in a secure infrastructure. To address the demand, industry firms are driving innovation in networking technologies, including network virtualization and Software-Defined Networking, which favor growth prospects.

Rapid Deployment of 5G to Boost Growth Prospects: The success of 5G technology depends on significant investments to upgrade infrastructure in the core fiber backhaul network to support growth in data services. Efforts to develop smart connected homes, hospitals, factories, buildings, cities and self-driving vehicles are promising for industry players. These companies invest heavily in LTE, broadband and fiber to provide additional capacity and improve Internet and wireless networks. These initiatives hold promise.

Wi-Fi 7 Upgrade Cycle to Drive Momentum: Brisk technological advancement, dynamic products, high-speed connectivity, low latency and evolving industry standards define the Computer - Networking industry. The growing influence of the latest Wi-Fi 6E-compliant residential gateways, Wi-Fi routers, set-top boxes and wireless range extenders is a testament to the same. The increasing demand for connecting more devices to the network has been driving demand for Wi-Fi 6E devices. Wi-Fi 6E addresses Wi-Fi spectrum shortage issues by providing continuous channel bandwidth to support a higher number of connected devices without compromising speed. The rollout of Wi-Fi 7 bodes well for the companies in this space.

Macroeconomic Turmoil is Concerning: Persistent concerns include global macroeconomic weakness and volatile supply chain dynamics. Tariff issues, especially between the United States and China, remain a burden on global supply chains. Inflation could affect spending across small and medium-sized businesses globally, and uncertainty in business visibility could hurt the industry's short-term performance.

Zacks Industry Rank Indicates Bright Near-Term Prospects

The Zacks Computer - Networking Industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #99, positioning it in the top 40% of more than 246 Zacks industries.

The group's Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bright near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

Before we present a few stocks you may want to consider for your portfolio, considering bright prospects, let us look at the industry's recent stock-market performance and valuation picture.

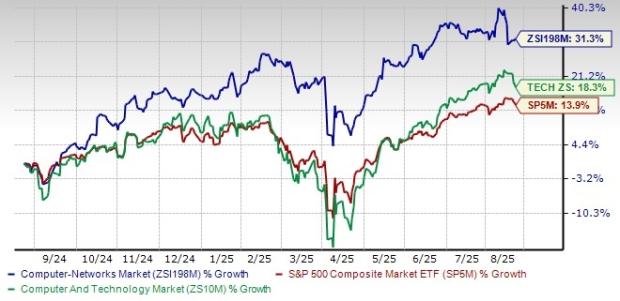

Industry Outperforms S&P 500 & Sector

The Zacks Computer - Networking industry has outperformed the S&P 500 Composite and the broader Zacks Computer and Technology sector in the past year.

The industry has gained 31.3% over this period compared with the broader sector’s rally of 18.3%. The S&P 500 has appreciated 13.9% over the same time frame.

One-Year Price Performance

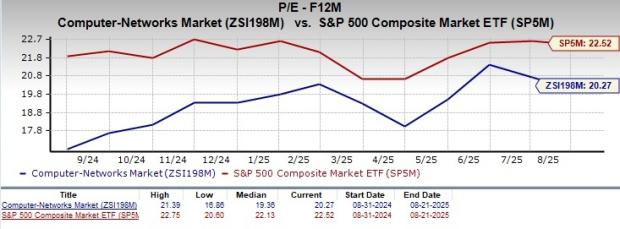

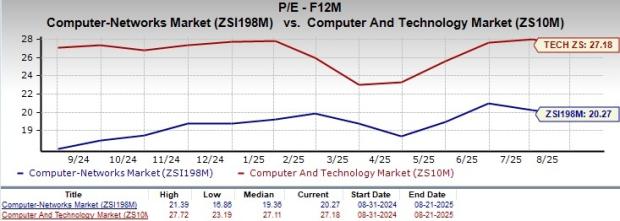

Current Valuation of the Industry

Based on the forward 12-month price-to-earnings ratio (P/E), which is a common multiple for valuing Computer – Networking stocks, the industry is currently trading at 20.27X compared with the S&P 500’s 22.52X. It is also below the sector's forward-12-month P/E of 27.18X.

In the past five years, the industry traded as high as 21.39X and as low as 16.86X, with media at 19.36X, as shown in the charts below.

Forward 12-Month P/E Ratio

3 Computer - Networking Stocks to Add to Portfolio

Extreme Networks: Based in Morrisville, NC, the company provides AI-driven cloud networking solutions. Strong demand for the company's wired and wireless network solutions is driving revenues, as reflected by 20% year-over-year revenue growth in the last reported quarter.

The launch of Platform ONE by Extreme, an AI-driven, holistic networking solution, marks a major innovation milestone. Momentum in subscription bookings is expected to grow with the adoption of Platform ONE and drive up SaaS annual recurring revenues (ARR). In the fourth quarter of fiscal 2025, SaaS ARR increased 24.4% year over year to $207.6 million. A larger footprint in EMEA and APAC is promising.

Driven by strong momentum, EXTR expects revenues to be $1.238 billion to $1.228 billion for fiscal 2026. Nonetheless, heavy reliance on product revenues and competitive pressures remains concerning.

Currently, EXTR has a Zacks Rank #2 (Buy).You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

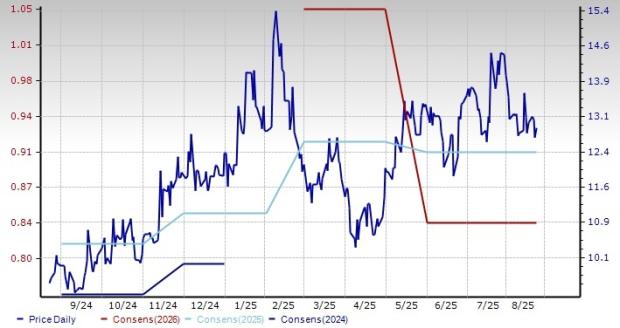

The Zacks Consensus Estimate for fiscal 2025 bottom line is pegged at $1.02 per share, unchanged in the past seven days. Shares have gained 34.1% in the past year.

Price & Consensus: EXTR

Cisco: Cisco is one of the largest players in the networking space. The company has a strong presence in the router and switch market. Its aggressive AI push and growing security dominance are noteworthy. Cisco is embedding AI across Security and Collaboration platforms and developing Agentic capabilities across the portfolio. It is leveraging Agentic AI to boost customer experience. The launch of Renewals Agent, an Agentic AI-driven solution co-developed with Mistral, and a new Assistant to help customers digitize and de-risk Network Change Management have been notable developments in this regard.

Cisco has deepened its partnership with NVIDIA to offer solutions that enable AI-ready data center networks. By integrating Cisco Nexus switches with NVIDIA’s Spectrum-X architecture, the companies are offering high-speed, low-latency networking designed for AI clusters, driving enterprise AI orders. Additionally, the Cisco Secure AI Factory with NVIDIA offers a trusted framework for sovereign cloud providers and emerging Neo cloud providers to build safe and AI-optimized data centers.

Cisco's security business is benefiting from strong demand for Cisco Secure Access, Hypershield, and XDR. Secure Access, XDR, Hypershield, and AI Defense added 750 new customers in the fourth quarter of fiscal 2025.

However, challenging macroeconomic conditions, as well as stiff competition in the networking and security domain, are expected to hurt Cisco's prospects in the near term.

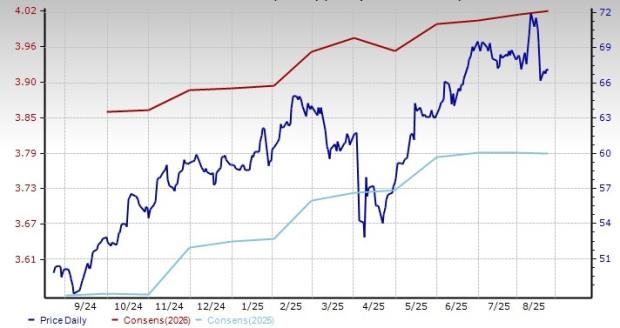

Currently, CSCO has a Zacks Rank #3 (Hold). The Zacks Consensus Estimate for fiscal 2026 earnings is set at $4.02 per share, an improvement from an estimate of $4.00 per share in the past 60 days. The shares have increased by 33.5% over the past year.

Price & Consensus: CSCO

RADCOM: This Tel Aviv, Israel-based company specializes in providing cloud-native, automated service assurance solutions for telecommunications operators for 5G networks.

RDCM is focusing on global sales expansion and deepening its strategic partnerships, with a clear push into AI-powered and accelerated computing solutions. It is simplifying automated assurance for AI-driven networks to access "previously untapped markets." It is continually investing in research and development to strengthen its leadership in 5G assurance, expand its solution offerings and support operators in their transition to next-generation networks.

RADCOM's collaboration with NVIDIA, announced earlier in 2025, is already showing momentum, with many customers progressing from discussions to lab deployments of RADCOM's high-capacity user analytics solution. On the last earnings call, RDCM highlighted that this validates the relevance of its solutions and the distinct competitive differentiation.

Fueled by a healthy sales pipeline, strong customer relationships, and the market's continued shift toward intelligent, automated, real-time assurance, RADCOM reaffirmed its full-year revenue growth target of 15%-18%, translating to a midpoint projection of $71.1 million. Nonetheless, customer concentration, currency headwinds, and rising costs could undermine growth prospects.

Currently, RDCM has a Zacks Rank #3. The Zacks Consensus Estimate for 2025 bottom line is set at earnings of 91 cents per share, unchanged over the past seven days. Shares have surged 34.5% over the past year.

Price & Consensus: RDCM

This article was originally published on Zacks Investment Research (The Shiro Corp).

0 comments:

Ikutan Komentar